On Demand Pay

With Keeper

Powered by employers, KEEPER™ gives staff instant access to earned salary before payday.

The Keeper Advantage

It's Simple. It's Transparent. And It Works.

Early Pay Platform

Join the premier early-pay platform providing employees with on-demand pay.

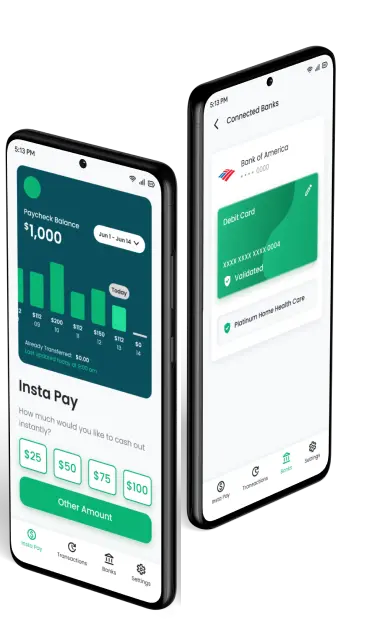

The Keeper App

Employees utilize the Keeper app to promptly withdraw daily wages.

Retain Employees

By providing earned wage access, businesses have seen significant decline in turnover rates.

Give Them Flexibility

With several disbursement options, Keeper empowers employees with the freedom to choose not only when they receive their funds but also how they receive them.

Join Keeper today to grant your employees the flexibility they need.

Give Them Control. It's Worth It.

Give Them Control

It's Worth It.

Give Them Control

It's Worth It.

Cultivate a happier and more engaged team

Offer a desirable benefit at little-to-no cost

Encourage employees to clock in and out

Incentivize direct deposit enrollment

Entice last minute replacements & fill shifts

Cultivate a happier and more engaged team

Offer a desirable benefit at little-to-no cost

Encourage employees to clock in and out

Incentivize direct deposit enrollment

Entice last minute replacements & fill shifts

What Our Customers Say

Hear directly from our customers about the exceptional service and results that sets Keeper apart

A large percentage of our staff are now able to cover basic needs, such as groceries or even an Uber to get to work when times are tight, through the Keeper platform.

Roz Zelman

CEO, Life Care Services

One of the most significant advantages we found with Keeper was their ability to provide industry-specific support. Keeper stood out as the ideal provider, being the only one that had specifically tailored their solution for healthcare settings.

Pinny Faska

COO, Rockaway Homecare

Keeper has proven to be a game-changer for us in terms of caregiver retention, with over 42% of Independent Home Health's caregivers enrolling in the program within a couple of months of its launch. Additionally, it's worth noting that 100% of users need to comply with Electronic Visit Verification (EVV).

Shaya & Levi

Partners, Independent Home Health